Medicare Supplement

At Right Health Benefits, we have all the expertise and resources needed to get you the best health coverage for you and your family.

A plan never costs you more just because you buy with a licensed Right Health Benefits insurance advisor. No matter what plan or plans you purchase, our goal is simply to make it easier for you to understand your options. We can save you, your family and your company money by comparing plans to best fit your budget, needs and lifestyle. We take the guesswork out of knowing you have the very best plan for your money. We can help you re-shop each year during the Obamacare open enrollment period, or any time life changes warrant the need to update your coverage. Our licensed insurance advisors maintain up-to-the-minute knowledge regarding healthcare regulations and are here any time you have questions regarding benefits or about the way a medical claim was processed.

RIGHT HEALTH BENEFITS

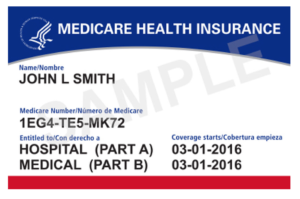

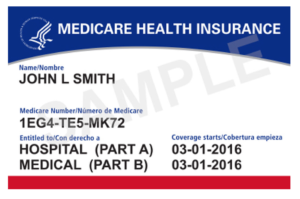

Although original Medicare plans typically include Medicare Part A (Hospital Insurance), Medicare Part B (Medical Insurance), and perhaps Medicare drug coverage (Part D) – a Medicare Advantage Plan offers coverage for expenses original Medicare doesn’t cover such as fitness programs (gym memberships or discounts) or vision, hearing, and dental services. You’ll even find that one plan may offer more benefits than another plan – some offer transportation to doctor visits, over-the-counter drugs, and health and wellness services. It’s also important to know that plans can be tailored to better meet the needs of those with specific health issues.

A Medicare Advantage Plan is simply another way to get your Medicare Part A and Part B coverage. Medicare Advantage Plans, sometimes called “Part C” or “MA Plans,” are offered by Medicare-approved private companies that must follow rules set by Medicare. If you join a Medicare Advantage Plan, you’ll still have Medicare but you’ll get most of your Part A and Part B coverage from your Medicare Advantage Plan, not Original Medicare.

Here are some considerations for when one is choosing a Medicare plan:

Do you wish it was easier to determine which plan best fits fit your needs, lifestyle and budget? It can become confusing if you don’t have all the facts … but Right Health Benefits licensed Medicare advisors are happy to compare plans for you and help you find the most beneficial, practical and desirable coverage options. Give us a call or send us an email. We will gladly make time for you so you can feel confident about making the choice that is right for you.

What is Medicare Supplement Insurance or Medigap? Simply put, it is insurance sold by private companies that can help fill “gaps” not paid by original Medicare. such as:

The federal government standardized these plans in most states, creating 12 options for consumers: A, B, C, D, F, G, K, L, M, N, HD-F, & HD-G. Each plan covers a different range of costs.

Do you wish it was easier to know which configuration best fits your needs, lifestyle and budget? Many things should be considered when making Medicare Supplement plan choices. It can become confusing if you don’t have all the facts.

Right Health Benefits licensed and knowledgeable Medicare advisors are happy to compare plans for you and help you find the most beneficial, practical and desirable coverage options. Give us a call or send us an email. We will gladly make time for you so you can feel confident about making the choices that are right for you.

Right Health Benefits saves you and your employees money! We know that one of the best ways to attract and retain star talent is by offering quality benefits. Many employees who could work independently opt to work for companies because of the valuable group health benefits that are provided.

It’s also important to know that the Affordable Care Act made health insurance coverage for companies with 50 or more full-time equivalent employees (FTE) mandatory for business owners. This means these employers are legally bound to share in the payment of a percentage of their employees’ group health insurance premiums. You can count on the guidance of your Right Health Benefits advisor to structure your health benefits package in a cost-effective manner which can both save you money and attract top tier talent.

Right Health Benefits licensed, knowledgeable advisors are happy to provide multiple quotes and options based on your budget and needs so you can make informed decisions regarding the benefits you offer your employees and help secure the best fit for your company.

If you do not have an employer-provided health plan, or if you are self-employed, individual health insurance is designed for you. Medical care costs continue to rise, and health insurance is a rapidly changing environment. Our licensed Right Health Benefits insurance advisors are knowledgeable and up-to-date on the many choices in companies, plans and coverage available and we are here to serve you.

Individual plans are required by the Affordable Care Act (ACA) to cover essential health benefits. Right Health Benefits licensed advisors can help you apply for any tax credit subsidies you may be eligible for and compare quotes on health insurance from multiple insurance carriers so you can get the best possible rate.

Just request a quote and we will be happy to see how much we can save you on quality health care.

Biannual dental check-up appointments are important for both oral health and overall wellbeing, because your exam is more than a simple check of the surfaces of your teeth. Your bite, tongue, gums, cheeks, jaw joints, neck, and lymph nodes are checked by your dentist because over 100 serious health issues can be detected by a dental exam. Heart disease, cancer, diabetes and stress are just a few conditions that a dental appointment can detect.

Studies show that people with dental insurance are twice as likely to have consistent dental checkups and cleanings. If your employer does not provide dental insurance, our licensed, knowledgeable Right Health Benefits licensed advisors are happy to show you several affordable dental insurance options to support you and your family. Many allow for regular checkups and cleanings at no additional cost. Just ask us a free quote to fit your needs and your budget!

At Right Health Benefits, we have all the expertise and resources needed to get you the best health coverage for you and your family.

The best way to preserve your health is by protecting it. At Right Health Benefits we have all the expertise and resources needed to get

Protecting your family from unexpected medical expenses is an integral part of a comprehensive financial plan and provides peace of mind. You can avoid unforeseen

FREE QUOTE

Complete for a free quote to fit your needs and your budget!

| Cookie | Duration | Description |

|---|---|---|

| cookielawinfo-checkbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checkbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |

At Right Health Benefits, we have all the expertise and resources needed to get you the best health coverage for you and your family. Right Health Benefits, owned by Harvinder Kaur, specializes in helping their community gain confidence and peace of mind regarding their health care coverage. We assist both young families and those with family members over 65. We have over 10 years of experience and are located in Edison, New Jersey. We offer expertise in Medicare Advantage Plans, Medicare Supplement Plans, Medicare Part D (Prescription Drug Coverage); DUAL Plans; Group Health and Benefit Plans; Individual Health Insurance Enrollments as well as Get Covered NJ Plans. So avoid unforeseen medical expenses, and enjoy the benefits of preventative care by getting your family protected today.